The heavy vehicle production industry in Mexico is configured to serve the export market, with exposure in North America, mainly to the United States, where 96.4% of foreign sales are destined. Under this premise, any slowdown in the demand for these capital goods has an effect on the production and export of heavy units.

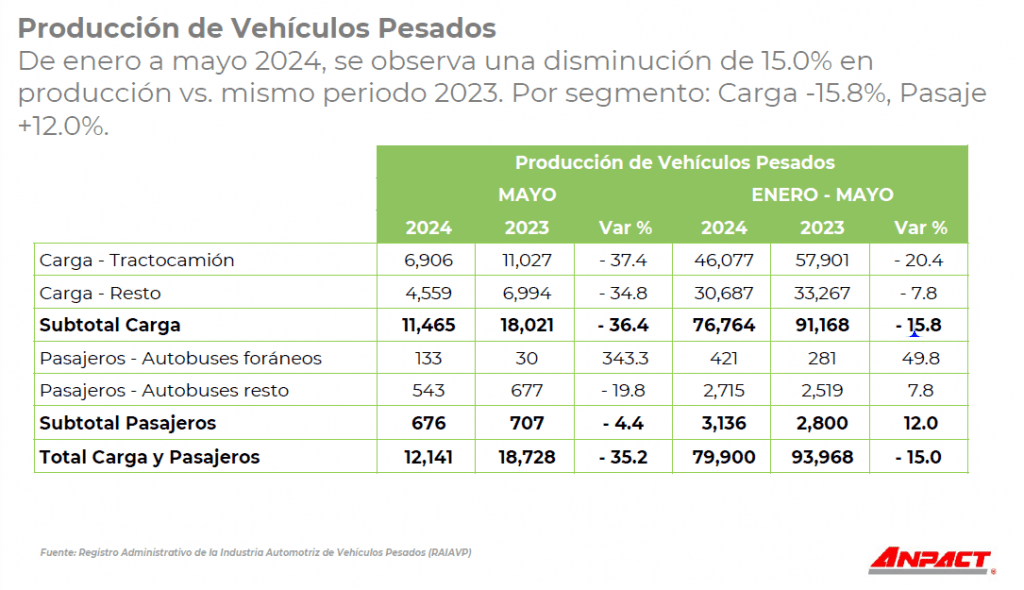

This is what happened in the production and export figures of heavy vehicles manufactured in Mexico, where according to the Administrative Registry of the Automotive Industry of Heavy Vehicles (RAIAVP), the production of cargo and passenger units totaled 12,141 during May, this represented a contraction of 35.1% compared to the figures reached in 2023.

Of the total production of heavy vehicles, 11,465 corresponded to cargo vehicles, a figure that represented a reduction of 36.4% compared to May of last year.

In the accumulated of the first five months of the year, the manufacturing of cargo vehicles registered 76,764 units, a reduction of 15.8% compared to 2023, which represents 14,404 fewer.

Production of heavy vehicles:

Regarding the export of heavy vehicles last May, it was 9,932 units, this meant a contraction of 33.1% compared to what was sent in the same month last year, when 14,845 units were placed abroad. Of the total exports, 9,927 corresponded to cargo vehicles, the figure observed a decrease of 33.1% compared to what was sent in May of last year.

In the accumulated January-May of this year, exports contracted 15.7%, going from 75,264 vehicles in 2023 to 63,404 in 2024. Of the total exports in the referred period, 63,385 corresponded to cargo units, this meant a reduction in exports of 15.8% vs. the first five months of 2023.

Alejandro Osorio, director of Public Affairs and Communication of the National Association of Bus, Truck and Tractor Producers (ANPACT) , explained in a press conference that the export of vehicles manufactured in Mexico is decreasing due to the moderation in demand from trading partners, mainly from the United States .

It should be noted that in the fifth month of the year, 9,854 units were sent to the northern neighbor, this represented a reduction of 30.3% compared to 2023. In turn, Canada imported 49 units, which meant a contraction of 89.5% compared to 2023. to the 468 that were sent during 2023. Colombia experienced a similar case when it went from 76 requests in the fifth month of 2023 to 12 in the same month of the current year, meaning that the country admitted 84.2% fewer units.

Osorio detailed that both the sales and production results of heavy vehicles produced in Mexico were also impacted by the recent disruption in the supply chain, particularly vision systems (mirrors) for heavy vehicles.

“This is because the main factory producing mirrors for the industry established in Escobedo, Nuevo León, caught fire last April, completely interrupting its operations, which has stopped the production of this auto part that is essential for vehicles to produced can be delivered and registered. This fact is affecting the continued delivery of vehicle orders because it is an essential auto part for road safety,” stated the ANPACT director.

Although to date the strategy that the heavy vehicle manufacturing industry will follow to accelerate the replacement of mirrors has not been detailed, Guillermo Rosales, executive president of the Mexican Association of Automotive Distributors (AMDA) , explained that there is already news of that the restoration of supply has begun , however, by June the impact will continue to be felt, it is expected that in July there will already be a normalization of the situation.