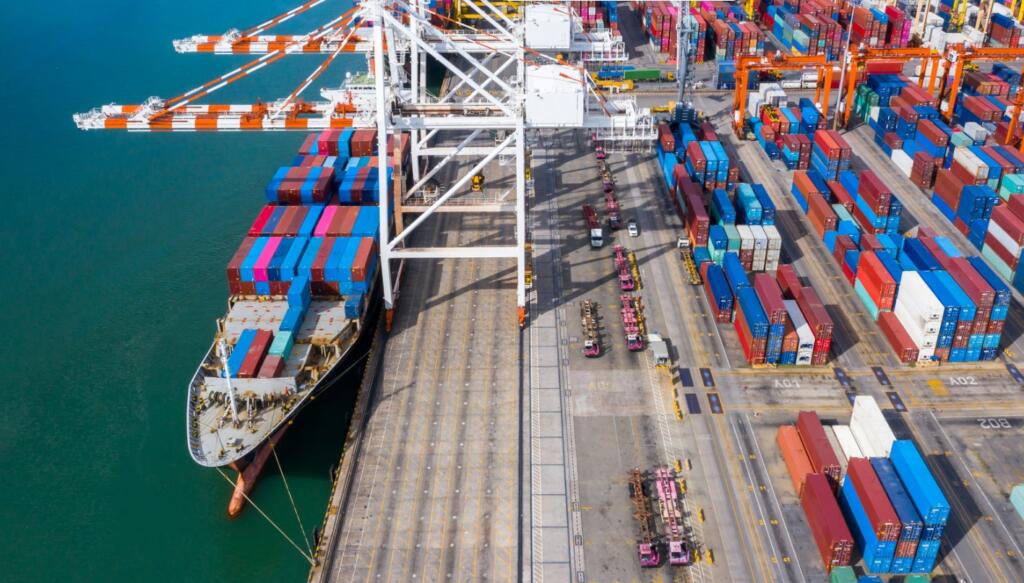

As of October 1, 2024, approximately 45,000 dockworkers along the East and Gulf Coasts, including ports in Houston, New Orleans, and Tampa, are poised to strike. This action poses a risk of disruptions across major supply chains in the southern United States. The International Longshoremen’s Association (ILA) has been engaged in negotiations for several months regarding key issues such as wage increases and automation concerns. Despite the U.S. Maritime Alliance offering what they term “industry-leading wage increases,” a resolution has not been reached. The primary point of contention remains automation, with the ILA expressing concerns over technological changes that could potentially impact job security (KNBA).

The Strike Implications

The potential strike could have significant implications for businesses reliant on port activity, particularly in the transportation and logistics sectors. According to data from the National Association of Manufacturers, East and Gulf Coast ports handle over 50% of containerized imports. Given the current fragility of supply chains, even a brief work stoppage could result in empty shelves and delayed deliveries. Jonathan Gold, vice president of supply chain for the National Retail Federation, states, “A single day of disruption could take several days to recover” (KNBA). It is advisable for retailers and manufacturers to monitor updates from key industry bodies such as the National Retail Federation and the U.S. Chamber of Commerce.

In an effort to mitigate potential impacts, many companies have initiated measures such as diverting shipments to the West Coast or expediting cargo. However, it should be noted that not all goods can be rerouted, particularly for industries that rely on just-in-time inventories. The proximity of the upcoming holiday season adds an additional layer of urgency, especially for retailers anticipating a surge in demand.

Industry leaders are advised to prepare contingency plans, which may include adjusting shipping routes and exploring alternative modes of transport. Government intervention appears unlikely at this time, as President Biden has publicly stated that he will not invoke the Taft-Hartley Act to prevent the strike, citing his support for collective bargaining (KNBA). For those seeking real-time updates, the Federal Maritime Commission and industry-specific resources will be valuable sources of information.

While wages and job security are central to these negotiations, the broader debate over automation in U.S. ports could have long-term implications for the future of the logistics industry. This potential strike underscores the importance of resilience in supply chain management as companies navigate higher costs and longer lead times.

Mexican Ports and the Opportunity for Collaboration

The ripple effects of this strike could also create opportunities for ports in Mexico to strengthen their partnerships with U.S. businesses. Veracruz and Altamira have already seen increased traffic due to nearshoring, and the current disruption may accelerate these trends. Enhanced rail and truck logistics between Mexican ports and southern U.S. cities could offer a long-term alternative for businesses looking to avoid future U.S. port disputes.

As labor tensions escalate in U.S. ports, Mexican maritime officials are signaling their readiness to step into the breach. In an exclusive interview with El Economista, Héctor López Gutiérrez, General Coordinator of Ports and Merchant Marine of Mexico, offered a bold statement of preparedness:

“We are prepared to handle a possible increase in maritime traffic. Our ports, especially Veracruz and Altamira, have the capacity and are ready to support our trading partners in case of disruptions in U.S. ports.”

This declaration comes as U.S. East Coast and Gulf ports face potential paralysis due to ongoing labor negotiations. The Mexican stance underscores a growing trend of nearshoring and highlights the country’s strategic position to capitalize on its northern neighbor’s logistical challenges.

Industry analysts suggest that this development could mark a significant shift in North American trade dynamics, potentially leading to long-term changes in supply chain strategies for multinational corporations operating in the region.

Comment and follow us on X: / @GrupoT21