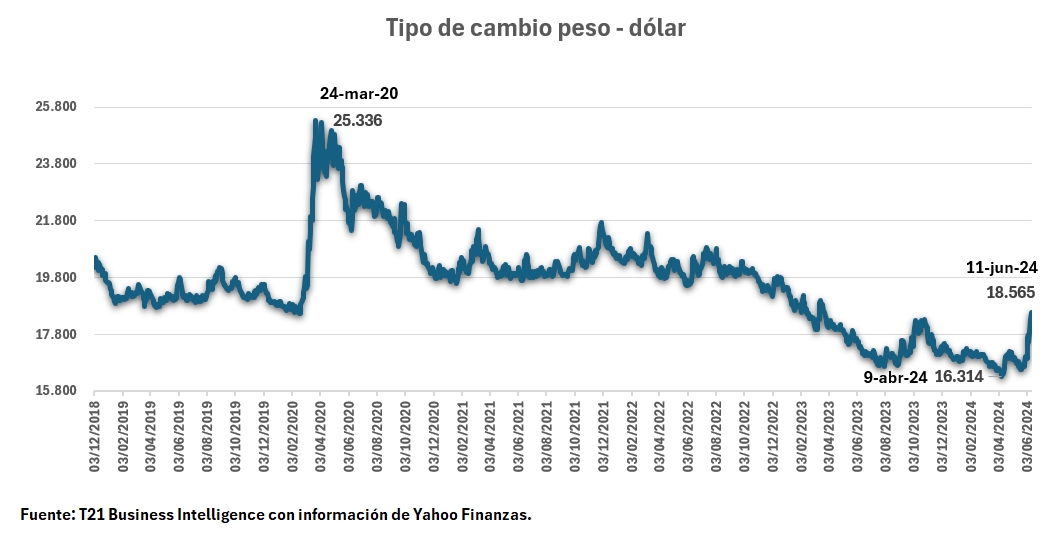

The peso-dollar exchange rate had maintained a downward trajectory with historical lows. Since March 24, 2020, where 25.33 pesos were reached for each dollar, there was a recovery of ground for the Mexican currency, until reaching its lowest level of the six-year period of 16.31 pesos on April 9.

Based on the electoral process that took place in Mexico and the possible formation of Congress that could imply constitutional changes that had been proposed by the current administration of President Andrés Manuel López Obrador, it has motivated a movement in the price of the peso – dollar, under The market’s reading that these changes could be counterproductive, John Soldevilla Canales, general director of the consulting firm EcoBI , told T21 .

“In each electoral period (April-June), the exchange rate has been unfailingly pressured: 10% in 2000 (election of Vicente Fox), 9% in 2006 (Felipe Calderón), 14% in 2012 (Enrique Peña Nieto ), 15% in 2018 (López Obrador) and 11% during this period,” commented Soldevilla Canales.

In the specialist’s perspective, “this exchange rate depreciation could induce an increase in exports, but this will be marginal and only short-term; in any case, road transportation will partially benefit from this side. However, this temporary benefit would be partially offset by the import side, of which 46% is carried out by road transport. For the trucking industry, there will be some benefit from exports, but not from imports. In the end, the net profit would be marginal”

Data shared by EcoBI identifies that of the total exports in 2023, which corresponded to 593 billion dollars, 65% of these were moved by road, where there has also been an increase of 10 participation points in the last decade.

Given this situation, John Soldevilla emphasizes that planning cannot be done based on this exchange rate movement, since according to what has been observed in other electoral processes, it has always returned to previous levels or close to them, “this year it could be particular, since several factors come together that could keep the exchange rate under pressure for the rest of the year,” highlights the general director of EcoBI.

Among these elements are the recent statements by the leader of the bench in the Chamber of Deputies , Ignacio Mier, where he anticipated that all the reforms proposed by the current head of the Executive would be voted on. Added to this is President López Obrador’s interest in approving his constitutional reforms at the last minute in September. Faced with this situation, the markets are reacting negatively: depreciation of the peso, a fall in the stock market and an increase in country risk.

In addition to the above, in November it is expected that Donald Trump will be the winner of the electoral process in the United States, who is expected to maintain his strategy of attacking Mexico and factors such as migration, tariffs, review of the T-MEC in 2026, among others; which could generate exchange rate pressures for the rest of the year.

In the same vein, Alejandro Saldaña, Chief Economist at Grupo Financiero Ve por Más (BX+), shared that, given the recent significant events that were not included in their year-end forecast, which originally ranged between 17.9 and 18.3 pesos per dollar, “it will have to be considered that Mexican assets might possibly trade with a higher risk premium and be somewhat more volatile going forward. However, the country continues to offer some favorable aspects, such as healthy public finances, a strong external position, and attractive interest rates.”

In 2016, when Donald Trump won, the peso depreciated 22% between May and November. “The exchange rate will close this year at 19 pesos or more. Once this situation has passed, the price would return next year to levels closer to 18 pesos ,” identified John Soldevilla.

In this context, companies that participate in foreign trade, such as transportation firms, benefit from a depreciation of the exchange rate, which is generated after a strong appreciation experienced in recent years (around 20%).

“The current 11% depreciation only partially compensates for the losses generated in these years by pesifying its export income. The same applies to freight motor carriers. If the latter have accounts receivable in dollars for 30, 60 or 90 days, it is advisable that they allow the time established in their contracts to pass, since the Mexican peso may remain under pressure for the rest of the year. This would cause an exchange gain and improve their balance sheets for the year,” Soldevilla Canales points out.

In the perspective of Alejandro Saldaña, Mexican exporters are taking the depreciation of the peso in a good way, “because they would be receiving more pesos for each dollar, in addition to gaining more competitiveness in international markets. Likewise, the consumption of locally produced goods could be more in demand over those that are imported, as the latter become more expensive.”