The main productive sectors of Mexico are experiencing a slowdown, which could significantly impact the demand for logistic and commercial services, as identified by a recent analysis by CIAL Dun & Bradstreet.

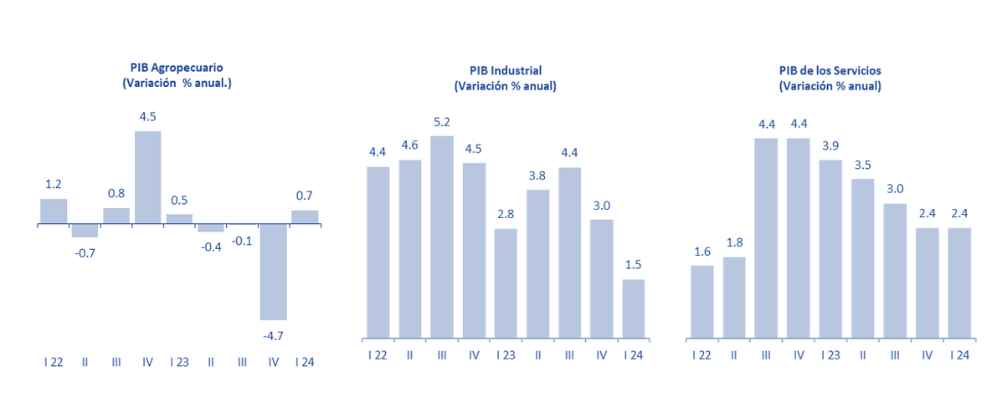

According to the analysis, the Mexican economy has shown signs of slowing down in the agricultural, industrial, and service sectors. During the first quarter of this year, the Gross Domestic Product (GDP) grew by just 1.9% annually, the slowest pace since the first quarter of 2021, when the country was beginning to recover from the 2020 pandemic crisis.

The agricultural sector recorded a modest increase of 0.7% annually. Meanwhile, the industrial sector grew by only 1.5%, reflecting a stagnation in manufacturing for several consecutive quarters.

Additionally, construction has shown a significant slowdown after strong growth in the second half of last year. Meanwhile, the service sector, although it grew by 2.4%, has also seen a moderation in its expansion rate.

Analysts at CIAL Dun & Bradstreet expect Mexico’s GDP to grow by 2.1% this year, a slight downward revision from the previous estimate of 2.3 percent. Meanwhile, for 2025, a growth of 2.8 percent is projected.

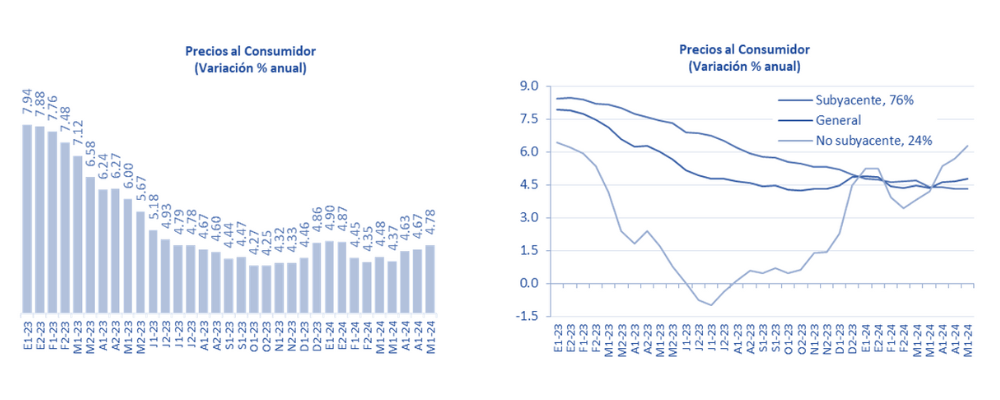

Additionally, inflation in the first half of May reached 4.78% annually, in line with market expectations. However, while core inflation decreased to 4.31%, non-core prices continued to increase at a rate of 6.27% annually, suggesting further increases in the coming months. This inflationary behavior suggests that the Bank of Mexico will maintain its reference rate at the current 11.00% to contain inflation.

Meanwhile, the commercial sector has also begun to feel the effects of economic moderation. Wholesale sales have remained weak due to industrial stagnation in the United States and the poor performance of Mexican exports. Retail sales, on the other hand, saw modest growth of 0.6% annually in March, a significant deceleration compared to previous months. This slow growth could be linked, according to the analysis, to employment slowdown, high interest rates, and moderation in real wages.

In contrast, revenues from private non-financial services grew by 3.9% annually in March, aligning with the positive performance of the services GDP, which continues to outpace the industrial sector in terms of growth.

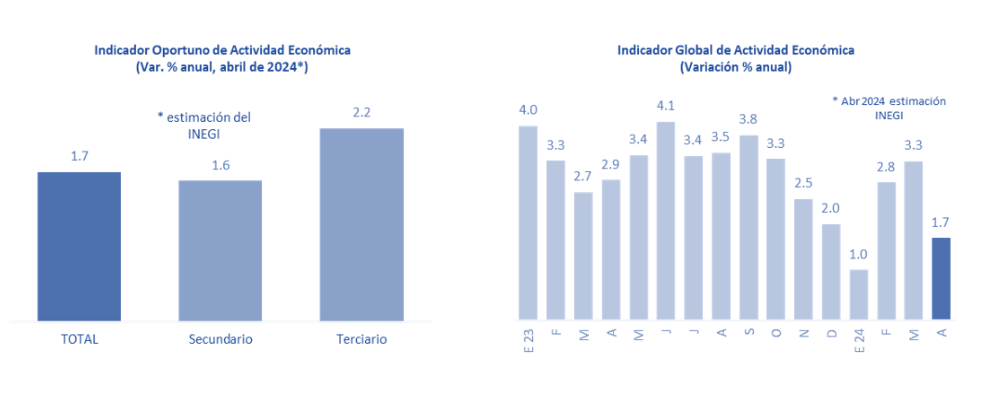

The National Institute of Statistics and Geography (INEGI) estimated annual economic growth in Mexico of around 1.7% in April, following strong results in February and March. However, a moderation in growth is expected throughout the year, with a GDP projection of 2.2% for 2024 according to the Citibanamex survey.

The analysis by CIAL Dun & Bradstreet also shows that so far this year, financial markets have demonstrated positive evolution. The exchange rate has remained below 17 pesos per dollar, which could provide some economic stability in a context of global and local challenges.

The scenario of deceleration affecting all productive sectors poses significant challenges for the demand for logistic and commercial services, while inflation and high interest rates remain persistent concerns. However, growth expectations for 2025 offer a perspective of moderate recovery that could revitalize the country’s economy.

Comment and follow us at X: @GrupoT21