The National Institute of Statistics and Geography (INEGI) has released the results of the National Consumer Price Index (INPC) for the first half of May 2024, revealing a significant increase.

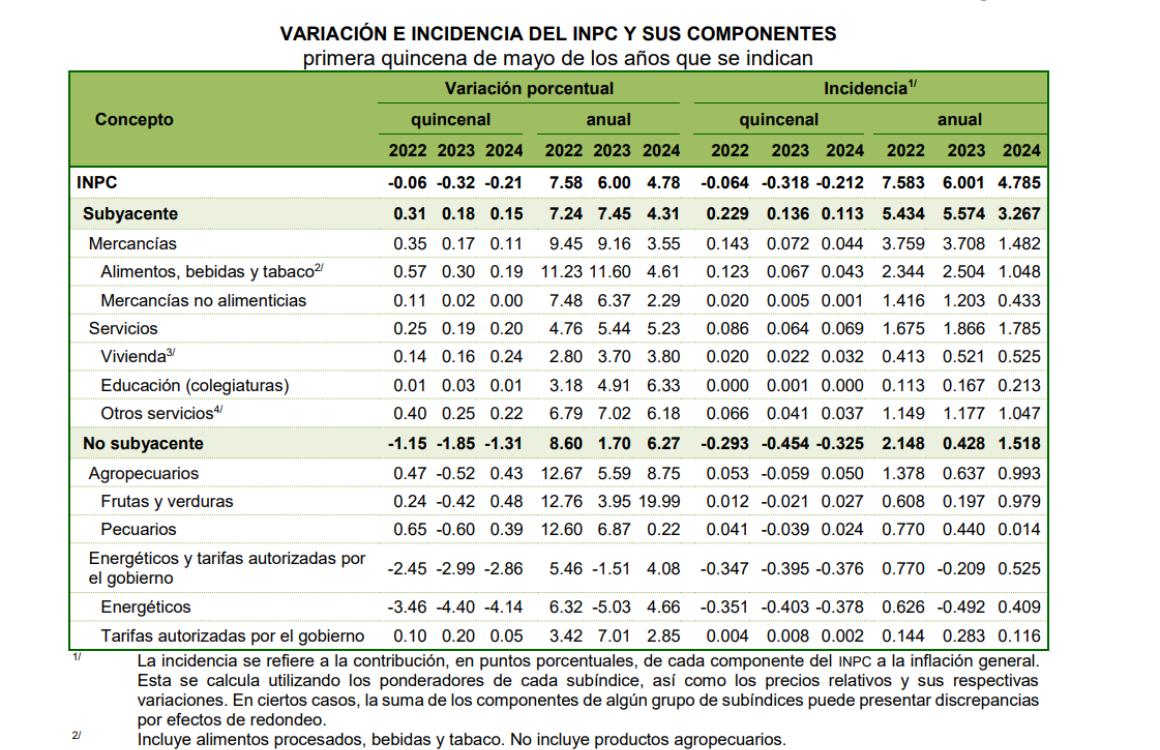

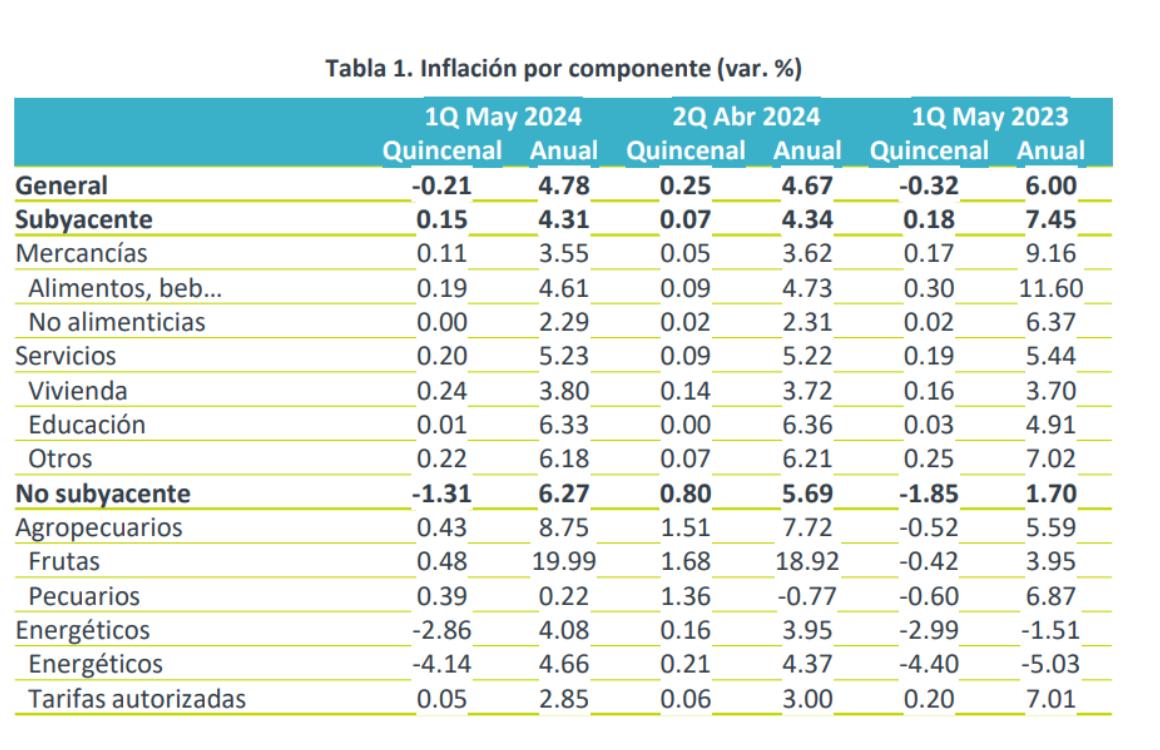

The annual general inflation stood at 4.78%, driven mainly by the increase in prices of agricultural and energy products.

Although the INPC decreased by 0.21% compared to the previous half due to the implementation of warm-season electricity tariffs in 11 cities in the country, this decline is lower than that recorded in the same half of the previous year, which was -0.32%.

The core price index, which excludes the most volatile components such as food and energy, showed an increase of 0.15% biweekly and 4.31% annually.

Within this index, the prices of goods increased by 0.11%, while services increased by 0.20%.

On the other hand, the non-core price index, which includes volatile components, recorded a biweekly decrease of 1.31% but an annual increase of 6.27%. In this category, agricultural product prices rose by 0.43%, and prices of energy products and government-authorized tariffs decreased by 2.86%.

In that regard, Grupo Financiero BX+ provided its analysis on consumer inflation in the first fortnight of May 2024, indicating a 4.78% annual growth, slightly below its projection of 4.81% and above the consensus of 4.75 percent.

In the analysis, they highlighted that year-on-year inflation accelerated, reaching its highest level since the second fortnight of January. They explain that this increase was driven by rises in agricultural and energy prices, although the underlying index grew at its slowest pace in three years. The variation in goods continued to decelerate, while services did not show a clear inflection point.

Bx+ also emphasized the implications of this data for future monetary policies, suggesting that an adjustment in the target rate of the Bank of Mexico could occur in June, provided that upcoming inflation readings show less pressure and some risks on the economic outlook dissipate.

In the study, they explain that the usual fortnightly decrease in May was mainly attributed to warm-season electricity tariffs, although the decline was smaller compared to the same period last year, due to increases in agricultural products and gasoline.

Regarding the year-on-year variation, BX+ comments that it increased for the third consecutive fortnight, marking its highest variation since January, driven by the dynamism of the non-core components, particularly agricultural and energy products.

They also explain that the core index grew at its slowest pace since May 2021, with a continued slowdown in goods, due to the dilution of previous shocks such as the pandemic and the war in Ukraine, as well as currency appreciation. Services, on the other hand, showed a marginal acceleration, especially in housing, although the rest of the services experienced minimal declines.

Comment and follow us on X: @GrupoT21