During this year, 62 million tons of cargo will be moved worldwide through airlines, 6.8% above the level recorded at the end of 2023; however, revenues are expected to decline by 13% year-on-year, anticipated by the International Air Transport Association (IATA).

“To improve profitability, resolving supply chain issues is crucial so that we can efficiently deploy fleets to meet demand,” said Willie Walsh, Director General of the organization.

Cargo revenues are expected to fall to $120 billion in 2024, down from $138 billion in 2023. Both have dropped dramatically from the peak of $210 billion in 2021 but are above the levels achieved in 2019, which were $101 billion, representing an improvement over the previous forecast of $111 billion (announced in December 2023).

“Despite the strength of demand, cargo yields are expected to fall by 17.5% in 2024, while remaining slightly above 2019 levels. This is a normalization after the extraordinary peaks of the pandemic. A key factor in this is the significant belly capacity (of aircraft) that entered the market in 2023 alongside the recovery of passenger travel,” he stated.

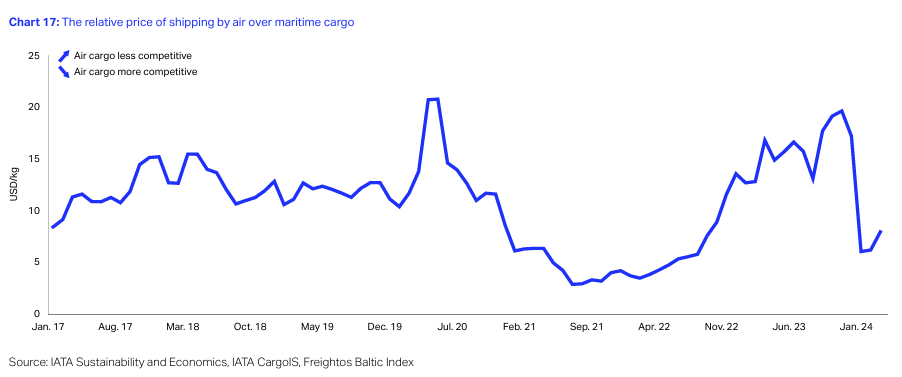

According to their work report, the impact comes from measures taken by countries to restrict international trade such as increased tariffs, as well as the situation in the Red Sea, the Panama Canal, and the Baltimore bridge collapse, which has once again caused a sharp drop in air cargo rates relative to maritime transport in the first quarter.

Regarding the global air cargo capacity, measured in Available Cargo Tonne Kilometers (ACTKs), it was noted that it recovered above 2019 levels in 2023, due to the reopening of China’s borders.

“This normalization of the ratio between cargo aircraft and belly cargo capacity will continue in 2024. And with the flourishing demand, it is expected that global air cargo capacity will continue to grow in 2024, albeit at a slower pace than last year,” he explained.

Overall, he indicated that air cargo is in a period of correction after an exceptional year in 2021. Yields, capacity growth, dedicated freighter belly share, and other key metrics are transitioning “from the extraordinary situation in the middle of the pandemic to a continuation of pre-pandemic trends and levels.”

During his speech at the 80th Annual General Meeting of IATA held in Dubai, he mentioned that by the end of 2024, 62 million tons of cargo will have been delivered, enabling a trade of $8.3 trillion.

At the end of May, IATA reported that air cargo demand, measured in cargo tonne-kilometers (CTK), increased by 11.1% compared to April 2023 levels (11.6% for international operations), marking its fifth consecutive month of double-digit year-on-year growth.

Comment and follow us on X:@evandeltoro / @GrupoT21